Final Up to date on September 3, 2024

Have you ever ever heard of inexperienced finance? Basically, it’s a sort of financing that helps eco-friendly tasks and initiatives.

This put up was sponsored by Clean Energy Credit Union All ideas and opinions are my very own; for extra data see my disclosure coverage.

This will embrace loans and investments that assist each folks and companies make extra sustainable adjustments – like putting in photo voltaic panels or switching to geothermal power.

Inexperienced financing ensures cash does good for each folks and the planet. As a result of sure, you may have a sturdy inexperienced economic system rather than an extractive one.

In line with The New Climate Economy, investments in inexperienced infrastructure and power may internet $26 trillion in direct financial advantages worldwide over a 12-year span. That features 65 million new jobs and $2.8 trillion in authorities income from carbon taxes within the yr 2030 alone.

Regardless of the earnings we may see from a greener economic system, the fossil gasoline business remains to be earning money. A technique they’re doing it’s by way of our financial institution accounts. We’ll get extra into that later.

That’s why it’s so essential to assist green banks that received’t make investments your cash into fossil fuels, however fairly, assist sustainable initiatives that promote a inexperienced economic system. Right here’s a newbie’s information to divesting from fossil fuels that ought to provide help to get began.

For those who’re able to put money into a sustainable future, right here’s the whole lot you’ll want to find out about inexperienced finance.

why clear power financing issues

Local weather change mitigation is certainly one of humanity’s largest tasks. And it’s not low cost. You may’t decarbonize the economic system and fortify civilization towards rising seas and wildfires with out huge quantities of spending.

The issue is the entities that maintain that type of cash are governments and banks. And most banks are investing your cash into fossil fuels.

In line with the Banking on Climate report, the world’s 60 largest banks have dedicated $6,900,000,000,000 over 8 years to the fossil gasoline business, driving local weather chaos.

JP Morgan Chase is main the way in which at $430.93 billion USD. Citi follows because the second-worst fossil financial institution, adopted by Financial institution of America, MUFG, and Wells Fargo. Barclays is the worst in Europe and Financial institution of China is the worst in China.

Here’s what that cash is funding:

- Tar sands: These are a combination of sand, clay, water, and bitumen. Bitumen is a thick, sticky, black oil that’s most well-known as a binding agent in street asphalt. Mining of tar sands causes environmental issues corresponding to greenhouse fuel emissions, land degradation and water air pollution. Suppose Enbridge’s Line 3 pipeline which runs roughshod over Indigenous rights.

- Arctic, offshore, and fracked oil and fuel: Oil and fuel extraction disturbs ecosystems, endangers wildlife and threatens the worldwide local weather system.

- Coal mining and energy: May cause intensive degradation to pure ecosystems corresponding to forests and may scar the panorama irreparably. On high of this, coal-fired energy crops emit greater than 60 completely different hazardous air pollution.

- Liquified natural gas (LNG): It’s primarily made up of methane, a greenhouse fuel 80 instances stronger than CO2 within the brief time period and 30 instances worse in the long run. Methane leaks into the ambiance all through the LNG manufacturing and provide chain.

If we’re going to restrict world warming to 1.5°C and totally respect human rights, and Indigenous rights particularly, banks should cease financing the fossil gasoline business totally.

That’s why investing in clear power tasks is essential for environmental sustainability. Banks want to begin financing renewable power tasks that make the transition off fossil fuels honest and only for everybody.

one answer: clear power credit score union

Now that you just perceive why switching to a sustainable financial institution is essential, let me introduce you to 1 potential answer to the issue: Clean Energy Credit Union.

Clear Power Credit score Union’s mission is to advertise clear power, environmental stewardship, and cooperative enterprises by way of the monetary companies they supply to their members.

Each greenback put into Clear Power Credit score Union goes in direction of funding clear power tasks for different members.

FYI, a credit score union is a non-for-profit monetary establishment that’s owned and managed by its members. Credit score unions, like Clear Power Credit score Union, provide most of the identical monetary companies as banks do, corresponding to accepting deposits, making loans, and offering bank cards.

Nonetheless, the principle distinction between them is that credit score unions typically provide higher charges and phrases than banks, and so they return their earnings to their members.

As a smaller credit score union, Clear Power Credit score Union prioritizes their members’ wants and values their suggestions. As an example, they by no means cost an overdraft charge and provide overdraft safety to supply peace of thoughts.

They’re additionally dedicated to all the time offering a private contact—they be certain that each name is answered by an actual particular person. Moreover, they try for accessibility with low obstacles to entry to help as many individuals as attainable.

Clear Power Credit score Union makes investing in clear power simpler and extra accessible, be it $5 or $5000. Every greenback is used to fund different’s clear power tasks.

Additionally they speed up the adoption of fresh power by providing personalized loans which might be particularly tailor-made to scrub power services and products.

Right here’s an extra take a look at the companies Clear Power CU affords and their advantages to each members and the setting.

clear power for all mortgage program

As a way to combat local weather change, we should make the transition off fossil fuels accessible to everybody. The issue with that is local weather options, like putting in photo voltaic panels or getting an electrical automobile, are expensive.

This impacts BIPOC and low-income communities further laborious, as they face extra obstacles to accessing the advantages of fresh power. Many low-income and minority debtors have confronted credit score challenges, systemic racism, financial injustice, and/or different types of injustice.

A possible answer to that is the Clean Energy for All Program. It’s centered on serving to underserved populations afford clear power by providing discounted mortgage charges and credit score issues.

The initiative consists of two applications:

- BIPOC Borrower Program: Goals to extend entry to inexpensive clear power loans for Black, Indigenous, and different Folks of Coloration (BIPOC).

- Low-Earnings Borrower Program: Goals to extend entry to inexpensive clear power loans for low-income debtors.

These applications assist debtors create a extra even taking part in area for minorities and low-income households.

The Clear Power For All program affords the next reductions on clear power mortgage charges:

- A 0.50% fee low cost on all Clear Power CU loans for debtors with a credit score rating 680+

- For debtors whose credit score rating is under 680, a reduced rate of interest to not exceed the designated fee for a 680-credit rating. This interprets to a fee low cost of at the least 0.50% and presumably extra.

member advantages

Many banks will not be clear with their funds and precisely what they’re supporting together with your cash. As an example, Clear Power CU members can really feel good understanding that their {dollars} are supporting the clear power motion fairly than being invested in fossil fuels.

Plus, members can calculate the impression of their {dollars} with their carbon offset calculator. For instance, let’s say you’ve gotten $500 in your account – you’d be offsetting 218lbs of carbon per yr. In line with the EPA, that quantity of carbon is equal to 240 miles pushed by a mean fuel powered automobile.

Listed below are just some member advantages:

- Members can earn excessive returns on their {dollars}, together with 3.50% curiosity on qualifying checking accounts and even greater returns on CDs.

- Minimal charges together with no month-to-month account charges, no overdraft charges, minimal to no ATM charges.

- Get pleasure from an establishment that’s centered on sustainability with debit playing cards comprised of bio-based, industrially compostable, polylactic materials, no mailed statements or paper and non-compulsory recycled checks upon request.

- Straightforward to entry accounts with on-line banking and a cell app in addition to a over 32,000 in-network ATMs, 5,000+ shared branches, and skill to deposit money and cash by way of CoinStar kiosks.

- A crew of passionate people that care about our members and the setting. If you name or chat you’ll discuss to a real-person who’s there to assist!

what makes clear power CU stand out:

Clear Power CU is a not-for-profit, member-owned group. That is very completely different from conventional banks, as a result of members are equal homeowners of the credit score union and have a say in the way it operates. Members usually elect a volunteer board of administrators to handle credit score unions.

Right here’s a look at among the distinctive monetary merchandise they provide:

Additionally they provide companies corresponding to on-line and cell banking, e-statements, ID-Pal Identification verification, coinstar and wire transfers.

All income earned is reinvested into the credit score union within the type of decrease rates of interest on loans, minimal charges, and better dividends on deposit accounts.

financing:

Clear Power CU may help you fiscal your sustainability mission.

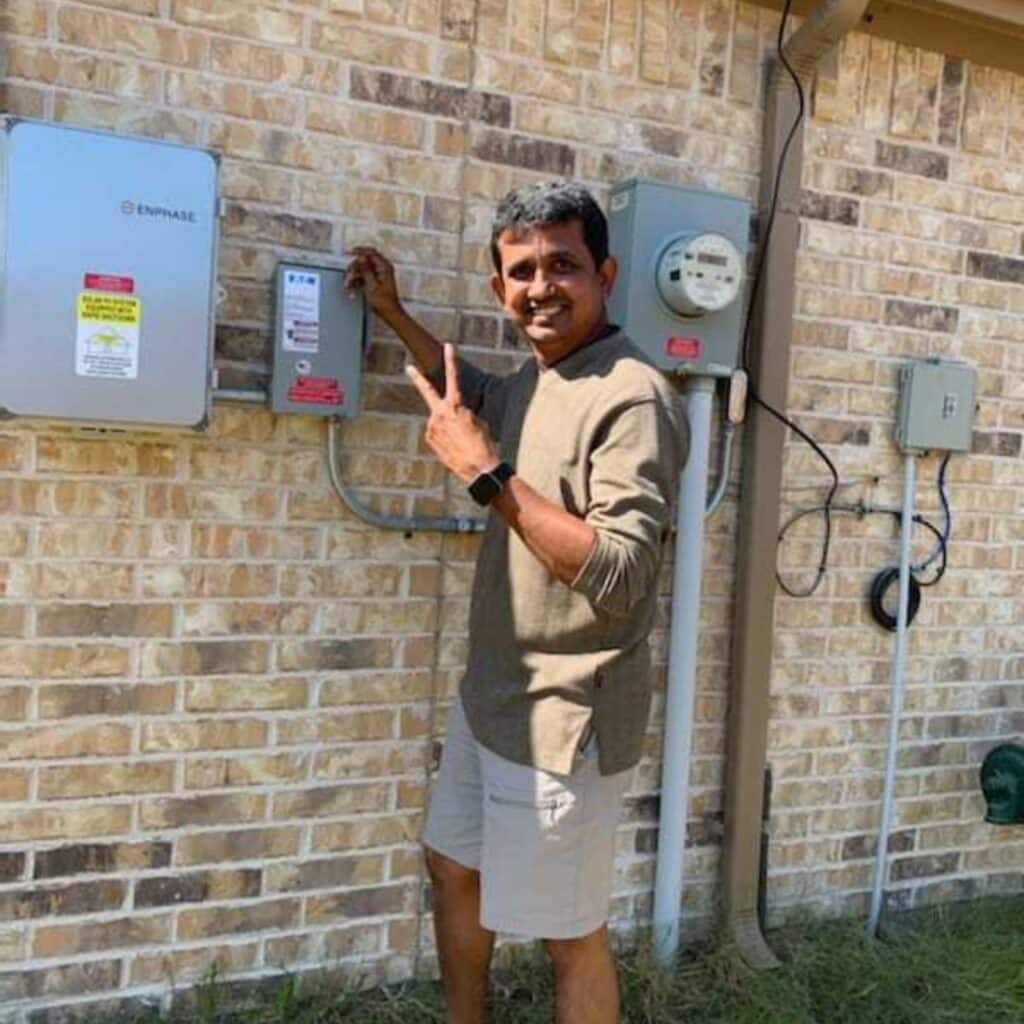

Let’s say you actually need to set up photo voltaic panels in your roof, however simply don’t have the funds in the intervening time. No worries! You may open a mortgage with Clear Power CU that may provide help to afford them and create a cost plan that works for you.

Listed below are some examples of sustainable tasks they finance:

- Photo voltaic panels

- Geothermal warmth

- Inexperienced dwelling enhancements

- Electrical autos + electrical bikes

This makes sustainable residing extra inexpensive and accessible, which finally helps lower down on carbon emissions and helps folks obtain net-zero houses. Think about if all banks did this?

extra methods to make your cash “go inexperienced(er)”

Alongside becoming a member of a inexperienced financial institution, there are different methods you may make your cash do extra for the planet. Listed below are some you may not have thought-about.

store your values

If you store, you’re voting together with your greenback. If we need to create a greener economic system, then we have to spend and make investments our cash into native communities, honest wages, and a sustainable future.

We are able to do that purchase opting to purchase:

- Sustainable manufacturers and merchandise made with organic, fair trade, and renewable assets

- Buying at our native farmers market or becoming a member of a CSA field

- Buying from native artisans and makers

- Gifting our family members eco-friendly merchandise designed to assist them dwell a extra sustainable way of life

devour much less general

Shopping for much less and utilizing what you’ve gotten is all the time probably the most sustainable possibility. And, it’s a confirmed cash saver!

Underconsumption core is at present trending on social media proper now, and for good purpose.

We’re continuously bombarded with ADs: Be it on social media, TV, radio, and so on. Celeb tradition additionally drives us to assume overconsumption is regular (like proudly owning 25+ pairs of footwear).

However the reality is, we don’t want enormous hauls or one other product to make us joyful. Regular life doesn’t appear like that. The truth is, it’s confirmed that overconsumption is making us extra stressed out and unhappy.

Selecting to purchase much less – whether or not or not it’s limiting your self to 1 or two splurges per 30 days, or taking a no purchase month problem – may help us really feel much less harassed. Our areas will really feel much less cluttered and our cash can go in direction of the objects we’d like or large milestones we’re making an attempt to save lots of for (like a house).

I wait thirty days earlier than making a purchase order. This helps me keep away from impulse purchases: If I’m nonetheless fascinated about that merchandise on the finish of the month, I’m going for it! I additionally ensure I take care of the clothes I already own and have defined my personal style so I’m really joyful re-wearing the items in my wardrobe.

get a inexperienced job

For those who’re on the job market, or nonetheless learning in school, contemplate getting a inexperienced job. Listed below are the best paying environmental science jobs.

Environmental science careers are so essential as we push towards cleaner sources of power and environmental safety. These jobs in environmental science will make a distinction and canopy your payments.

Some require regulation levels, whereas others provide the very best paying jobs with a biology diploma for an environmentalist profession no matter your specialty.

You can even take a look at the green job board by Kristy Drutman (browngirl_green). It’s up to date on a constant foundation and options sustainable jobs solely, detailing if it’s entry-level, the wage estimate, and the placement.

The Biden administration additionally rolled out The American Climate Corps: If you join, you’ll receives a commission to work on local weather options. They’ve all completely different sorts of jobs from clear power to group resilience.

save in your water and electrical energy invoice

Do you know that saving cash in your water and electrical energy payments may assist the planet?

Take into consideration this: Power and water are priceless assets. To activate lights and watch TV, we’d like electrical energy which frequently is generated from fossil fuels. And our water is a pure useful resource that’s renewable, however restricted. If we devour an excessive amount of contemporary water than nature can restore, the quantity of freshwater out there can lower.

A technique we are able to combat the local weather disaster is thru decreasing water or power waste. Right here’s how to save cash in your water bill and electrical invoice (in each the kitchen and bathroom) – whereas saving assets.

take motion: break up together with your financial institution

So, if you wish to begin your inexperienced finance journey, I encourage you to think about becoming a member of Clean Energy Credit Union. By becoming a member of, you can be serving to them put money into extra clear power and environmental stewardship for a greater tomorrow.

Nonetheless uncertain about breaking apart together with your financial institution? Take a second to search out out what your financial institution invests in. You are able to do this by testing Bank.green, GreenAmerica.org, Bankforgood.org, and asksustainable.com. All of them have financial institution lookups the place you may see in case your financial institution is funding the local weather disaster.

Break up together with your fossil gasoline funding banks and be a part of Clear Power Credit score Union as an alternative!

Trending Merchandise